The 8-Minute Rule for American Income Life

Table of ContentsFacts About Term Life Insurance Louisville Uncovered

depends on your individual needs. A term life policy makes sense if you think you only will need protection for a period. Term life likewise has a tendency to be a lot more budget friendly than whole life, so it can make sense for those concentrated on remaining within a budget. "Term insurance policy benefits someone that has an insurance policy demand for only a set variety of years,"states Jason Wellmann, senior vice president of life distribution at Allianz Life.

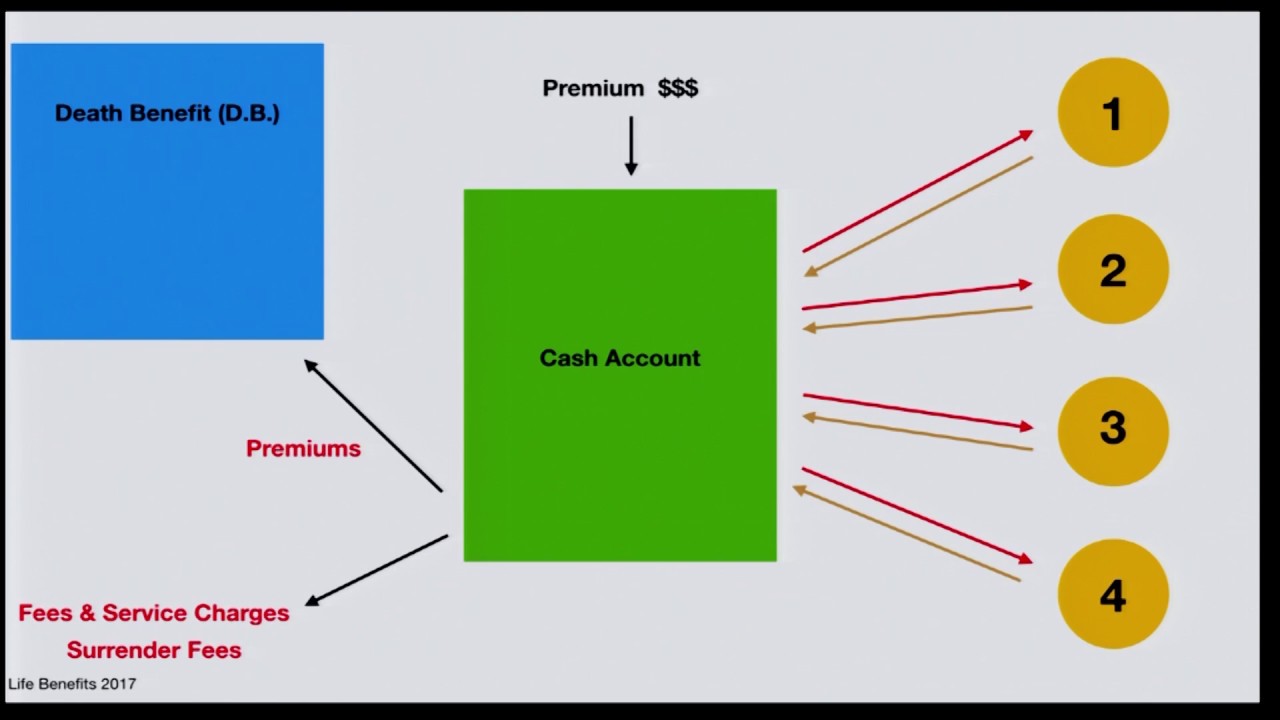

Whole life insurance policy additionally makes feeling for those who wish to secure one superior rate as well as keep that cost for as long as they live."The survivor benefit continues to be in area for the entire life time of the insured, as long as enough costs are paid, "Wellmann states. Entire life likewise supplies a" cash money value"account that attract those hoping to gather a bigger swimming pool of savings. You can access cash value in the type of a car loan or withdrawal from the money value. The cash could be made use of for things such as: Aiding with a kid's university education, Financing retirement income, Paying for emergency situation expenditures, Exactly how to pick a life insurance policy protection quantity? You may ask yourself,"How much life insurance policy do

I require?" When purchasing life insurance coverage, choosing the right amount can be challenging. Some experts suggest acquiring a benefit that will pay out seven to 10 times an insurance holder's annual income. Working closely with a life insurance policy agent can assist you establish how much coverage you need given your special scenario. Life insurance online. Just how much does life insurance policy cost?Average life insurance policy cost is a little a misnomer due to the fact that the expense of a life insurance policy can vary widely by person. Women live longer, so they tend to pay reduced costs. Healthier individuals pay reduced premiums than those with some clinical problems. You will certainly pay greater premiums if you smoke. Individuals with high-risk hobbies-- such as sky diving-- might pay higher premiums. Jobs that entail even more physical threats can cause greater costs. If you're searching for inexpensive life insurance policy, recognize that term life protection is

usually less costly than whole life coverage, for instance. Just how to minimize life insurance policy? The ideal life insurance policy plan is the one that totally fulfills your requirements. Buying life insurance policy is constantly a balancing act in between getting the insurance coverage you need as well as snagging the ideal life insurance policy rates."Recognize what is very important to your financial plan and examine yearly."Another crucial method to conserve is to compare life insurance prices. By doing this, you can find the most effective policy at the very best cost. Exactly how to obtain life insurance coverage quotes? You have a number of alternatives for acquiring life insurance policy quotes. One method is to narrow a listing to numerous insurance companies and also to obtain private quotes from each of them, either by calling their offices or using their website

. Obtaining life insurance policy quotes online is among the most effective means to save. Among the simplest and also quickest ways to collect quotes is to utilize a service like the one provided by Simply enter your postal code as well as you will promptly get a number of life insurance policy prices quote in simply a couple of minutes. Here are some concerns to address: Do you have enjoyed ones relying on your revenue for their health? Exists a favored charity or create you desire to sustain economically? Do you wish to give cash to cover your last expenditures? Depending on your objectives, you may assign one or even more link individuals to be recipients. Choices may include: Every one of the survivor benefit arrive in a solitary settlement (Life insurance). Some beneficiaries find it easier to obtain the cash slowly over a duration. Some insurers might permit a beneficiary to maintain the fatality benefit

in an interest-bearing account. Beneficiaries can after that write checks against the cash in the account. Unless the annuity is established for a collection period, any type of continuing to be death benefit continuing to be when the recipient dies will go back to the insurance provider. Cancer life Insurance. Just how does a recipient make an insurance claim? The Insurance coverage Info Institute suggests